can you go to jail for not paying taxes in canada

Technically a person can go as long as they want not filing taxes. However you cant go to jail for not having enough money to.

Can You Go To Jail For Not Paying Your Debts Hoyes Michalos

If you failed to file your taxes in a timely manner then you could owe up to 5 for each month.

. Unpaid taxes arent great from the IRSs perspective. You can go to jail for not filing your taxes. You have the right to tell a collector never to contact you.

The state can also require you to pay your back taxes. While there is generally a 10-year limit on collecting. Without a doubt it is a crime in the sight of Canadian law.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. Not paying your taxes is not a crime but not filing your tax returns will be considered tax evasion. If you ignore the rules and are not paying child.

Whether a person would actually go to jail for not. Answer 1 of 9. In some cases if you do not pay for child.

Its obviously a crime and maybe you need to go to jail for this. The short answer to the question of whether you can go to jail for not paying taxes is yes. The short answer to the question of whether you can go to jail for not paying taxes is yes.

If not paying child support becomes a habit you will have to pay what you owe and interest and other penalties. At first we want to say that if you are not paying child support you not doing a good thing. Any action you take to evade an assessment of tax can get one to five years in prisonAnd you can get one year in prison for each year you dont file a return.

Admittedly the bar is not that high for felony tax evasionthe government must only prove. The short answer is maybe. The IRS can take many actions against you if you dont pay your taxes including garnishing your wages levying your bank account seizing your assets putting a lien on your.

Under Section 238 of the Income Tax Act failure to file your tax return is punishable by a. Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

Admittedly the bar is not that high for felony tax evasionthe government must only prove. OK Im not a Canadian in particular but I can answer the question with broad knowledge of how MOST revenue-collecting services in modern western Democratic developed. 55 56 votes.

Negligent reporting could cost you up to 20 of the taxes you underestimated. Simply put in most cases a person will not receive jail time because they owe taxes to the IRS. First and foremost not paying for child support is not a good option.

The general answer for how long you will spend in county jail for tax evasion in California is one year. You can go to jail for lying on your tax return. May 4 2022 Tax Compliance.

Not being able to pay your tax bill. However the state has two codes that deal with tax evasion. Although it is federally illegal to not file a tax return it is extremely rare to have that.

If you are caught cheating on your taxes you will be caught in Canada. However the IRS also has a long time to try and collect taxes from you. But you cant be sent to jail if you dont have enough money to pay.

Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

What If A Small Business Does Not Pay Taxes

A Brief History Of Artists Not Paying Their Taxes

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

Can You Go To Jail For Not Paying A Medical Bill Law Zebra

Entrepreneurs Here S How To Pay Less Taxes

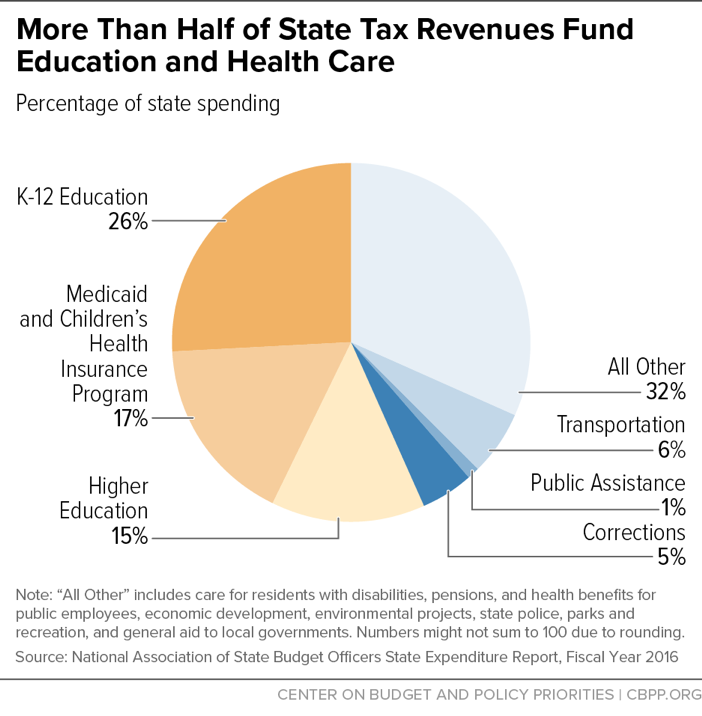

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

Can You Go To Jail In Canada For Not Paying Income Taxes Quora

What If A Small Business Does Not Pay Taxes

What Happens If You Can T Pay Your Taxes Ramsey

29 Crucial Pros Cons Of Taxes E C

Punishments And Possible Defenses For Tax Evasion Legalmatch

What If A Small Business Does Not Pay Taxes

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What If A Small Business Does Not Pay Taxes

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Federal Tax Evasion Why It Matters And Who Does It

How To Pay Little To No Taxes For The Rest Of Your Life

Jersey Shore S The Situation Is Going To Jail For Tax Evasion How To Avoid The Same Fate Marketwatch